The credibility gap in the AI industry

In recent years, the AI industry has sold an extremely convincing story:

- AI will explode productivity

- AI will reduce costs

- AI will automate knowledge work

But today's figures show a more nuanced and less sexy picture.

The AI paradox: mass adoption, but limited business impact

According to recent studies:

- More than 80% companies are experimenting with generative AI, but only a minority sees measurable impact on sales or profits (McKinsey).

- Only ~38% of organizations report clear EBIT impact of AI initiatives (McKinsey Global Survey).

- But 30% of CEOs are satisfied with the ROI of AI projects (Gartner).

- Gartner predicts that More than 40% of agentic AI projects will be shut down by 2027 due to costs, governance issues or unclear business value.

- At the same time, the global AI investment towards hundreds of billions to trillions of euros per year (IDC, PwC, McKinsey).

The paradox paradox is:

👉 unprecedented investments

👉 limited proven business impact

This isn't a failure of individual companies. Organizations are currently doing exactly what they were promised: experimenting, investing, and implementing. The structural problem lies elsewhere. The industry has positioned AI as a near-guaranteed productivity machine, while the reality is far more complex. The gap between marketing promises and enterprise reality is now creating disappointment, budget pressure, and cynicism. In other words, this is less an enterprise-execution problem and more an industry-level expectation failure.

AI is cheap. AI projects are not.

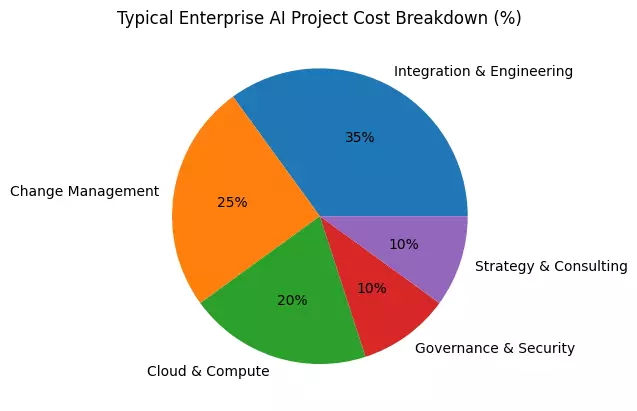

One of the biggest misconceptions in the market is that AI is cheap. The focus is often on token fees, Copilot licenses, or API prices. These are visible costs, but they usually represent less than 10% of the total investment.

The real costs are in everything that is needed to make AI usable, safe and scalable within an organization.

In enterprise environments, the total cost per AI project often around €1–5 million, with an average of around €1.9 million per use case suggested by analyses of consultancy and research reports.

Where does all that AI budget actually go?

1) Cloud, compute and data infrastructure (€200k – €1M+)

Even without your own AI model, infrastructure costs are significant:

- GPU usage and training

- vector databases and embeddings

- data lakes, pipelines and storage

- enterprise LLM licenses and platform costs

For larger companies, the server cost alone can six- or seven-figures per year become, especially with large-scale internal co-pilots or automation workflows (agents).

2) Integration and software engineering (€300k – €2M+)

AI without integration is a demonstration. With integration, it's an organizational change.

The costs are in:

- data engineering and data quality

- integration with ERP, CRM, legacy applications

- custom middleware and AI applications

- monitoring, observability and MLOps tooling

So this is the real technical work. This is often where the majority of the budget goes, especially in organizations with outdated IT systems.

3) Governance, legal and security (€100k – €500k+)

With GDPR and the EU AI Act, governance costs are no longer a nice-to-have (and a good thing too).

Typical cost items:

- AI risk assessments

- legal frameworks and policies

- security audits

- logging, prompt auditing and access control

For regulated sectors (finance, healthcare, government) this is often a structural costs.

4) Change management and training (€200k – €1M+)

The most underestimated cost, because AI changes how people work. And people don't change on their own.

Costs are included in:

- training and onboarding

- process redesign

- internal communication

- HR and culture transformation

In many projects it is change management 30–50% of the total investment. After all, adoption means returns.

5) Strategy, pilots and external partners (€200k – €1M+)

Most companies start with:

- strategy workshops

- pilots and PoCs

- consultants and implementation partners

Many projects get stuck here and never scale up, but the costs are incurred. This is a good example of how strategy without execution is expensive advice without business impact.

The real eye-opener is that tokens are not the problem are

In many enterprise AI projects:

- <10%: model and token fees

- >70%: organization, integration and governance

The AI industry is selling with low API prices.

But AI transformation isn't an API problem. It's an organizational problem.

When CEOs and CFOs approve an AI project, they expect ROI based on licensing fees. But in reality, they are buying a multi-year transformation program.

That explains why:

- do not scale up pilots

- budgets are coming under pressure

- AI is seen as “too expensive”

The sector sold tokens. Companies received a transformation program.

The ROI Illusion: Time savings ≠ money savings

Many AI business cases are built on this reasoning:

“If an employee saves 30% time, we save 30% wages.”

But in reality:

- time is rarely converted into staff reduction

- employees use time for other tasks

- processes remain the same

A simple ROI calculation example

- 100 employees

- €80k total annual cost per employee

- AI saves 20% time → theoretically €1.6M value

But:

- AI project costs €2M

- no headcount reduction

- no process rework (speeding up a shitty process with AI only makes shit faster)

Result: negative ROI.

AI only makes money if:

- processes are redesigned

- decisions are automated

- capacity is really redistributed or monetized

The credibility of the AI sector

The AI sector has oversold itself. In marketing, keynotes, and investor decks, AI was positioned as digital workers, autonomous agents, and 10x productivity machines. The reality today is considerably less spectacular: copilots, decision support, and individual automation components that primarily support existing processes. While valuable, this isn't the narrative that was sold to companies and investors.

This mismatch between promise and reality creates a credibility problem. And that gap is now becoming a strategic risk, precisely at a time when the sector is investing unprecedented sums in infrastructure. Hyperscaling AI providers like OpenAI and Microsoft are building data centers at a pace not seen since the dotcom bubble. This is a classic hype-driven investment pattern, similar to previous technology cycles: capital flows faster than proven business value. The social and economic legitimacy of these investments therefore increasingly depends on visible ROI, not on marketing promises.

In concrete terms, this means for companies:

- budgets are examined more critically and frozen more quickly

- Pilots and PoCs are stopped before scaling up

- AI projects are shifting from strategic to experimental because they pose a risk to core business

- Hype turns into cynicism among management and employees

“"AI's biggest risk today isn't technological. It's credibility."”

Technology rarely fails because of technology. Narratives fail because of credibility.

If the industry doesn't close the gap between marketing and reality, AI risks failing not as a technology, but as a promise.

A call to AI providers

The AI sector is at a crossroads. If providers want to accelerate enterprise adoption, the narrative must shift from hype to hard business reality. Less marketing. More economics.

The added value of AI lies not in tokens, but in integration, process redesign, and organizational change. Models and APIs are infrastructure components; without downstream implementation, they generate no business impact. Integrators and consulting firms are doing the heavy lifting today: integrating data, designing governance, automating processes, and involving people in change.

But AI providers can't completely hide behind a "we only provide tokens" position while simultaneously promising transformation and ROI. Whoever sells the promise bears responsibility for the economic reality of implementation.

The fundamental mismatch is clear: Providers are optimized for scale and usage economics, while companies buy outcome economics. That gap explains much of the current disappointment surrounding AI.

What AI providers need to do to close the credibility gap

1) Stop using token pricing as a narrative, publish real TCO models

Don't just show API costs, but the full cost structure: integration, governance, security, data engineering, and change management. CFOs make decisions based on total cost of ownership, not tokens.

2) Stop making 10x promises, communicate realistic productivity gains

In enterprise context is 5–30% productivity gains while transforming.

10x is an inspiring narrative, but not an enterprise baseline. Expectations must align with operational reality.

3) Stop generic demos, build repeatable business use cases

Enterprise buyers don't buy models, they buy solutions.

Focus on proven domains such as:

- predictive maintenance

- fraud detection

- procurement automation

- customer service deflection

- internal knowledge workflows

Make them repeatable, with references and benchmark data.

4) Stop licensing and move to outcome-based accountability

Not: “We provide a model.”

Well: “We reduce your operational costs with 12%, otherwise we will pay our share.”

Price AI on business results, not on tokens or seats.

When providers sell transformation, they must also take financial responsibility for the impact: a fee as a percentage of achieved cost savings, revenue uplift, or cycle time reduction. Share risk and upside with the client, as in performance-based outsourcing and managed services.

Anyone who sells ROI must also be prepared to be held accountable for it.

The quantitative figures in this article are based on compiled benchmarks from consultancy reports, industry surveys, and real-world cases. They serve as indicative reference points; actual costs and ROI vary significantly by organization, use case, and maturity level.

AI is a historic shift, but without sufficient ROI it remains hype

AI is one of the biggest technological shifts of our generation, if not the biggest.

But the industry is at a crossroads: either AI matures as an enterprise infrastructure layer, or it evolves into the next hype cycle with disappointment and budget discipline.

The difference won't be determined by model parameters, benchmarks, or token prices. It will be determined by credibility, governance, and real business cases that demonstrate measurable impact on costs, revenue, and productivity.

AI is cheap. AI projects are not.

And the sector must dare to say that honestly.

At Canyon Clan, we believe the true value of AI comes downstream: in integration, process redesign, and organizational change. That's why we don't focus on models, but on concrete use cases, governance frameworks, and implementation processes that deliver measurable business impact. As an integrator, we combine strategic advice with technical implementation, ensuring AI doesn't remain an experiment, but a scalable part of the core business.

The next wave of AI will not be won by who builds the best models, but by who can embed AI in organizations in a reliable, responsible and economically viable way.

Thomas

CEO, Canyon Clan